Found in the ever-evolving landscape of financial investment possibilities, property has actually constantly shown its strength and long-term worth. As we relocate right into 2024, numerous factors converge to materialize estate an incredibly compelling investment option. This write-up delves into the key reasons realty stays a keystone of wealth building and discovers essential financial investment ideas for browsing the market in the coming year.

The Enduring Charm of Property Financial Investment.

Property Financial investment holds a special setting in the investment world as a result of its substantial nature and multifaceted advantages. Unlike stocks or bonds, real estate represents a physical possession that can generate revenue, appreciate in value, and supply a sense of security. A number of factors contribute to its long-lasting allure:.

Concrete Property: Property is a physical asset that you can see, touch, and also stay in. This tangibility provides a sense of security that can be lacking in even more abstract financial investments.

Earnings Generation: Rental residential properties can generate a stable stream of easy revenue, supplying a reliable source of capital.

Gratitude Potential: In time, property often tends to appreciate in value, raising your net worth.

Inflation Hedge: Real estate usually serves as a hedge versus inflation, as residential or commercial property values and rental fees have a tendency to increase together with the basic price level.

Tax Benefits: Numerous nations supply various tax benefits genuine estate financiers, such as deductions for home loan rate of interest, property taxes, and depreciation.

Why Real Estate Stands Out in 2024.

Several aspects make Real Estate an specifically eye-catching financial investment in 2024:.

Possible Market Changes: After periods of rapid price development, some markets may experience adjustments, developing opportunities for wise capitalists to purchase homes at much more desirable costs. This is not a universal forecast, and local market analysis is important.

Proceeded Demand for Housing: Regardless of economic changes, the essential demand for real estate remains continuous. This guarantees a constant demand for rental properties and sustains long-term property worth gratitude.

Reduced Interest Rates ( Possible): While rates of interest have actually been climbing, they might stabilize or perhaps lower in some areas, making funding more obtainable and increasing cost. This is a vital element to watch.

Diversity Benefits: Realty supplies diversity advantages to an investment portfolio, as it often tends to have a reduced connection with various other property classes like supplies and bonds.

Essential Investment Tips for Real Estate in 2024.

Navigating the realty market needs careful preparation and calculated decision-making. Right here are some crucial financial investment tips to consider in 2024:.

Conduct Thorough Research: Before investing in any type of building, conduct thorough study on the regional market, including home values, rental prices, and financial patterns.

Focus on Capital: Prioritize homes that generate favorable capital, implying that rental income goes beyond expenses.

Consider Location, Area, Area: Location remains a critical factor in property investing. Pick residential properties in desirable areas with strong rental demand and possibility for gratitude.

Manage Threat: Expand your profile by investing in different sorts of homes or various geographic areas.

Protect Funding Carefully: Search for the best mortgage rates and terms. Consider the effect of rate of interest fluctuations on your monthly settlements.

Hire Specialist Help: Think about collaborating with a trustworthy realty representative, residential or commercial property supervisor, and monetary advisor.

Due Diligence is Secret: Constantly conduct complete due persistance prior to buying a home, including inspections, assessments, and title searches.

Long-Term Perspective: Property is a long-term financial investment. Hold your horses and concentrate on building equity gradually.

Stay Informed: Keep updated with market trends, economic problems, and adjustments in guidelines that Investment Tips might affect your financial investment.

Kinds Of Real Estate Investments to Take Into Consideration.

There are various kinds of Property Investments to discover:.

Residential Qualities: Single-family homes, townhouses, and condos.

Multi-Family Features: Apartment and duplexes.

Industrial Properties: Office buildings, retail areas, and industrial buildings.

Realty Investment Company (REITs): Publicly traded companies that own and operate income-producing property.

Verdict.

Property remains to be a compelling financial investment chance in 2024. By recognizing market characteristics, performing comprehensive research, and complying with audio investment ideas, investors can position themselves for long-term success in this vibrant market. While no financial investment lacks danger, realty provides a one-of-a-kind combination of substantial worth, income capacity, and gratitude leads, making it a keystone of a well-diversified investment portfolio. Remember to seek advice from qualified professionals for customized monetary suggestions.

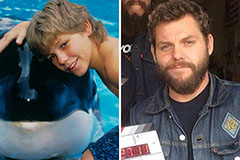

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Batista Then & Now!

Batista Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!